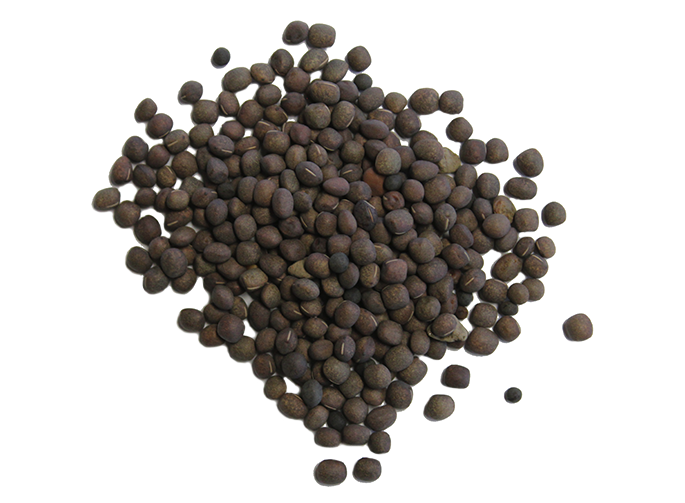

With 20+ years in the industry, we know what works. Each product we carry has been researched and tested in our own operations. Our trusted cover crop brands include Bio-Till and Grassland Oregon. We carry brassica, legume, grass and cereal for both warm and cool seasons.

For additional research you can view our seeding rates or use our trusted crop selector tool. Contact our team of specialists to help you select the right products for your operation.

+618 922 7446

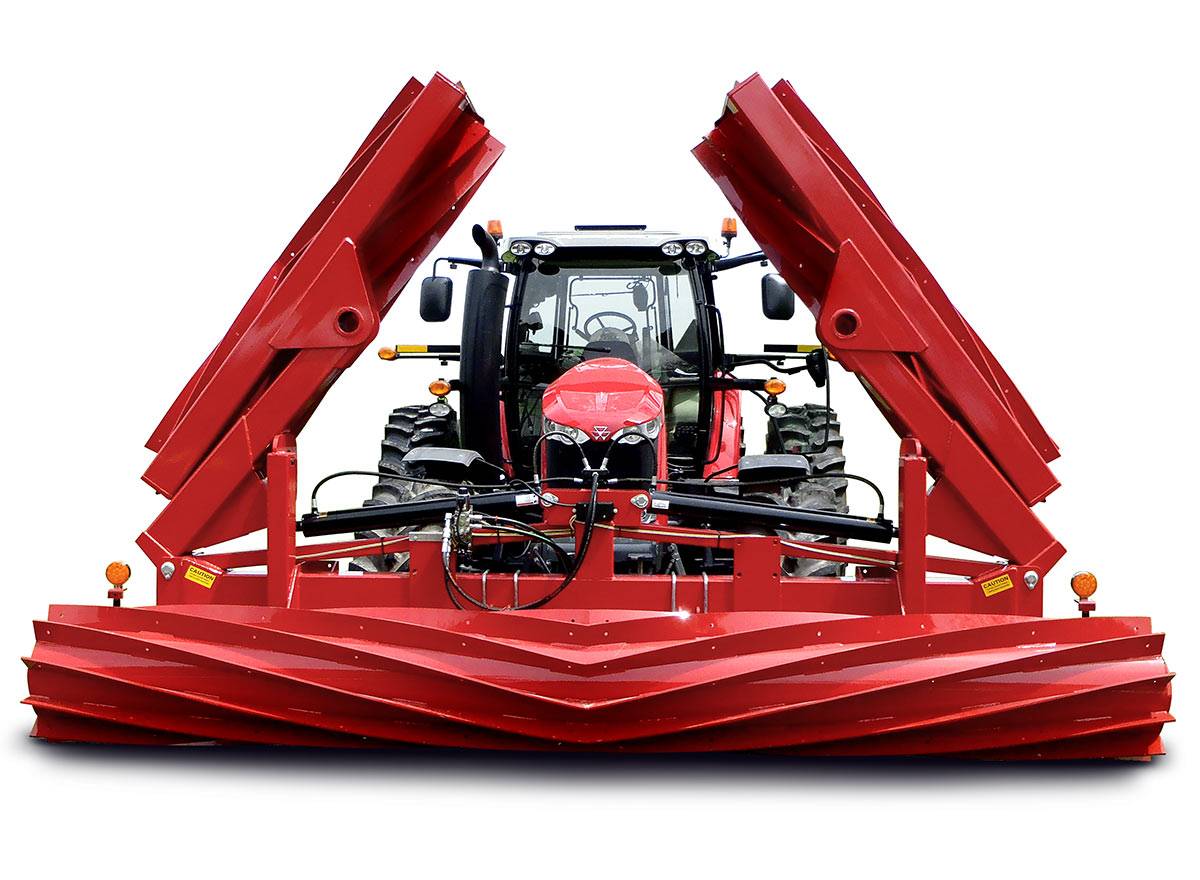

Our selection of I&J mfg. Crop Rollers has over 20 years of design innovation with the Rodale Institute. These Crop Rollers are engineered to be user friendly with lasting quality for an extended life span. We carry a wide variety of rollers to fit a diverse range of operations. Advance Cover Crops provide rollers nationwide.

To learn more about crop rollers benefits, click here. Contact our team of specialists to help you select the right products for your operation.

+618 922 7446

The selection of Progressive Ag Innovation Crop Rollers delivers a wide range of roller size options so you are able to find the one that is right for you. Advance Cover Crops provide rollers nationwide.

To learn more about crop rollers benefits, click here. Contact our team of specialists to help you select the right products for your operation.

+618 922 7446

Customer Service Is Our Priority

If you need no-till farming solutions, we are available for you. Our team of specialists are ready to guided you in selecting the right products for your operation. Call or contact us below.

+618 922 7446

Bio-Till

Offering cover crop products of interest to the no-till, strip-till and conservation-minded communities, Bio Till Cover Crops mission is to provide an arsenal of warm and cool season cover crops to help farmers protect and enhance their soil between cash crop plantings.

Grassland Oregon

A breeder, producer and provider of a wide range of seed products, Grassland Oregon Inc evaluates more than 4,000 unique lines of multiple species annually on their farm. They also test their varieties in diverse climates around the world in countries such as Australia, Canada, France, Italy and South Africa to name a few.

Advanced Cover Crops only selects the best products in the industry. Our selection of Crop Rollers has over 20 years of design innovation with the Rodale Institute. These Crop Rollers are engineered to be user friendly with lasting quality for an extended life span.